Subscription blindness: Not a thing.

Also: cash is a privacy preserving ecosystem and we now know how much violence is too much violence.

I fixed a lot of stuff today. My furnace broke and while I am not crazy enough to try to fix the fireball-maker in my basement, I did fix the (also) broken thermostat. On the heels of that tremendous success, I then fixed a wall clock and even a Soda Stream. None of that stuff is terribly technical, but the process I used to fix ‘em all was. Problems with things you know nothing about are hard to fix. But in my line of work, that’s all we do - solve big hairy problems that have no visible solution. The trick is to break the thing down into a bunch of smaller parts, and then work your way through those smaller, easier, bits until you stumble across the one that’s broken. That works for software, and it works for thermostats, wall clocks, and Soda Streams.

Subscription blindness. The struggle is (not) real.

There’s a class of apps called “automated financial assistance apps”. I don’t know if that’s a good name for them, you tell me: these apps log in to your bank and credit card accounts and scour your recent transactions for subscriptions that you may not want and offers to cancel them for you.

Like…why? Who wants this? Who among us has so many subscriptions that we simply cannot keep track of them and need thousands of lines of code and privacy-invading apps to help? (Jon 1:18)

This sounds like a solution looking for a problem, but thankfully Truebill has thought long and hard about the problem it is solving:

The average American spends around 44 hours per week working. That doesn't leave much time to think about money.

Umm, no. There’s nothing that people spend more time thinking about over the course of their lives than money. So what’s the real deal?

Truebill collects, among other stuff, your “name, e-mail address, mailing address, mobile phone number, social security number, and demographic information” and depending on what you do in the app, they may also collect “your personal financial information, such as your current income level, current expenses, investable assets, and other financial information”

Ugh. OK, so what does it do with this info?

We may use your e-mail address or other personal information (a) to contact you for administrative purposes such as customer service, to address intellectual property infringement, right of privacy violations or defamation issues related to your User Content posted on the Service or (b) to send you promotional materials, offers, messages related to the Service and the activities of third parties we work with.

OK. So these apps rifle through my personal financial information under the guise of “helping” me find subscriptions that I have somehow become blind to coming off my credit card each month, and then they allow third parties to use that data to sell stuff to me. Got it. Hard pass.

When cash is gone, so is our privacy

As we become a cashless society, what we’re really giving up is some of our freedom from surveillance and control. Cash is really about citizen control or lack of control. When people pay cash for stuff, nobody else has any way to see that transaction. There’s no way to tax it, there’s no way to track the goods that transferred hands, and there’s no way to build useful statistics like GDP (said nobody ever). Credit cards, Interac, bank transfers, and whatever other tools banks whip up are far more desirable to those who wish to watch us.

Governments love centralized finance and somewhere in that love affair is the reason why cryptocurrencies will never reach fiat status. They’re fine for speculating, or even for buying the infrequent thing from that weird guy or store that takes crypto coins, but because those transactions have the same invisibility as cash, cryptocurrencies are never going to get the high-level support to become mainstream.

Daniel Jeffries has written a very long, but very interesting, treatise on just this topic. Bookmark it for your commute (do we still commute during Covid?) and give it a read.

Beheading isn’t quite bad enough

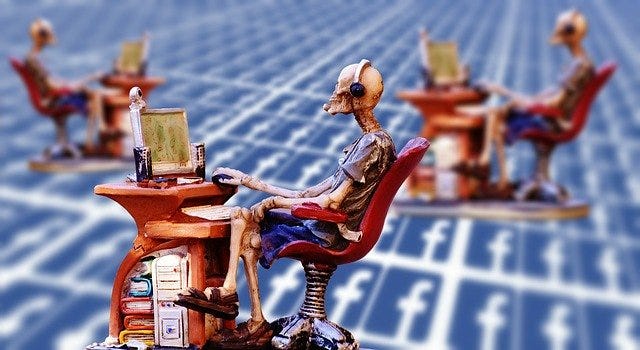

In case you were wondering exactly where the line is for Facebook to ban your account, it’s somewhere between beheading people and rushing the US Capitol.

Bannon suggested in a video posted on Nov. 5 that FBI Director Christopher Wray and government infectious diseases expert Anthony Fauci should be beheaded.

…

“We have specific rules around how many times you need to violate certain policies before we will deactivate your account completely,” Zuckerberg said. “While the offenses here, I think, came close to crossing that line, they clearly did not cross the line.”

Sorry, I got that wrong. It isn’t that beheading isn’t a bannable offense, it’s that Bannon hadn’t said enough people should be beheaded. Obviously, if Bannon had said…say…three people should be beheaded, that would be enough. Maybe. It’s not clear where that line is.

I can’t even imagine the type of thought process that goes through the minds of Facebook moderators, Zuck included. It takes a really spectacularly slanted view of the world to stand up in front of your staff and say someone hasn’t yet been violent enough to be banned. Especially when the violence in question is literally beheading someone.

I think about that all the time when I am on Facebook. I’ve left Facebook one less time than I’ve come back, and I lose a little bit more respect for myself every damn time I come back. Maybe one day I can even those tallies up.

If you’re a free subscriber and you like what you’ve read, encourage me to write more. Click the button below for an outrageously good deal!